Learn More

Our Programs & Options: Deconstructing the Capstone Plus Advantage

At Section-125, we believe in providing transparent and comprehensive solutions. The Capstone Plus program is an innovative, IRS-compliant (Section 125) benefit offering that integrates multiple powerful components to deliver significant tax savings for your business and enhanced health and financial wellness for your employees.

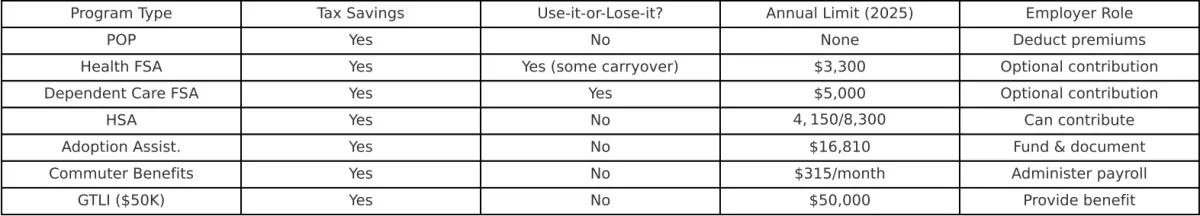

The Core Pillars of Capstone Plus

How It Works:

Employee contributions for Capstone Plus are deducted from their pay

before taxes (federal, state, FICA) are calculated. This immediately lowers their taxable income.

Benefits & Impacts For Your Business:

Direct FICA Tax Savings: Save 7.65% on your matching FICA contributions for every pre-tax dollar an employee contributes. This adds up to substantial annual savings.

Reduced Workers' Comp Premiums: A lower taxable wage base can also mean lower workers' compensation costs.

Simplified Compliance: With over 50 years of experience as a TPA (since 1968), Section-125 ensures your Section 125 plan is set up and managed correctly, meeting all IRS rules, including those expanded under the Affordable Care Act.

For Your Employees:

Immediate Tax Savings: They pay less in taxes, resulting in more take-home pay.

Increased Spending Power: Tax savings make valuable Capstone Plus benefits more affordable.

Our Programs & Options: Deconstructing the Capstone Plus Advantage

At Section-125, we believe in providing transparent and comprehensive solutions. The Capstone Plus program is an innovative, IRS-compliant (Section 125) benefit offering that integrates multiple powerful components to deliver significant tax savings for your business and enhanced health and financial wellness for your employees.